36+ Mortgage calculator with state taxes

Purchase price of the house your down payment the mortgages interest rate as well as property taxes and insurance. Property taxes in the state of Iowa are a major source of revenue for local governments and services including public schools.

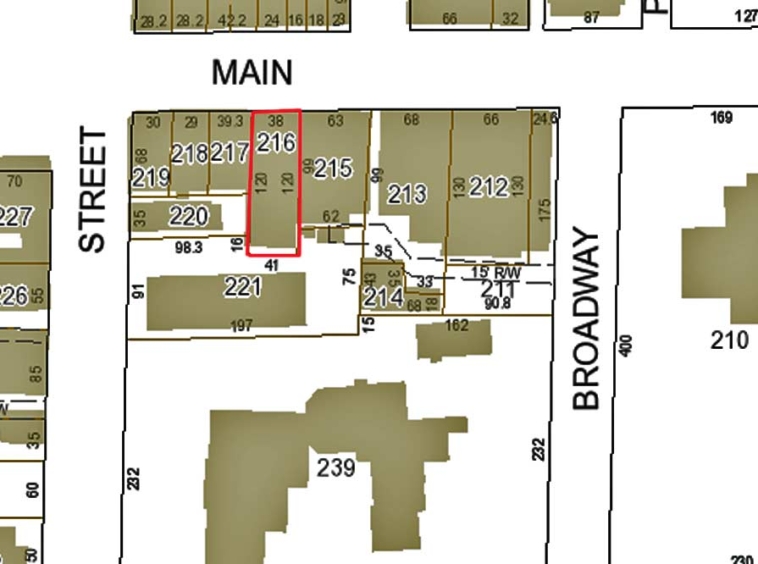

59 61 Main Streets Houlton Me Mooers Realty

Here is where you enter the additional costs that are typically billed as part of your monthly.

. On top of that bill youll have to consider property taxes and homeowners insurance as two more recurring expenses. To the 2836 rule which says to not spend more than 28 of your gross monthly income on housing expenses and only 36 of your income on. This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI.

Sale Price - Down Payment. The mortgage calculator with taxes and insurance allows a borrower to include property taxes and homeowners insurance so that one can get a complete. Check the IRS website for the latest information about income taxes and your state tax website for state-specific information.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and. Your monthly mortgage payment will consist of your mortgage principal and interest. Get a clear breakdown of your potential mortgage payments with taxes and insurance included.

Fannie Mae chief economist Doug Duncan believes the 30-year fixed rate will be 28 through 2021 and reach 29 in 2022. Actual payment could include escrow for insurance and property taxes plus private mortgage insurance PMI. 2021 2022 Mortgage Rate Housing Market Predictions Mortgage Rates.

FHA mortgage calculator to calculate monthly payment along with Upfront Annual MIP Taxes Home Insurance Extra Payments on your FHA loan. Beneath the mortgage rate table we offer an in-depth guide comparing conforming. We also publish current Boydton conventional loan rates beneath the calculator to help you compare local offers and find a lender that fits your needs.

Previously around 47 million Americans itemized deductions though under the new laws it is expected over 90 of taxpayers will simply use standard deductions. See how changes affect your monthly payment. Taxes and insurance vary state by state and city by city.

Owning property in Wyoming however will only put you back roughly 057 in property taxes one of the lowest average effective tax rates in the country. In the United States Social Security is the commonly used term for the federal Old-Age Survivors and Disability Insurance OASDI program and is administered by the Social Security Administration. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan.

Generally lenders are looking for a ratio of 36 or lower though it is still possible to get a mortgage with a debt-to-income ratio as high as 43. Your household income location filing status and number of personal exemptions. Use this calculator to estimate your monthly home loan payments for a conforming conventional home loan.

Lenders look most favorably on debt-to-income ratios. Use SmartAssets free Texas mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. Mortgage calculator results are based upon conventional program guidelines.

Fortunately Texas is one of the few states that doesnt levy transfer taxes or include a state recordation tax which will save you a percentage of overall costs. The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022. The Maximum Mortgage Calculator uses your current financial situation to calculate the maximum monthly mortgage payment that you can afford.

How Income Taxes Are Calculated. The states average effective property tax rate is 153 which ranks among the top 15 rates in the US. Property taxes in California are a relative bargain compared to the rest of the nation.

Currently FHA mandates a minimum 35 down payment towards your house. The main reason home loan calculators ask for your zip code is so they can estimate your property taxes. You should lookup county-level FHA loan limits for your State and enter the home value accordingly.

Account for interest rates and break down payments in an easy to use amortization schedule. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Other loan programs are available.

Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Property taxes vary widely from state to state and even county to county.

You have to pay taxes and insurance on your house. Using our mortgage rate calculator with PMI taxes and insurance. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Taxes vary by state and may. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. 85436 Balloon Payment Amount Loan Amount Total Interest.

For example New Jersey has the highest average effective property tax rate in the country at 242. To be paid each month. The state of things with your annual salary for the period of the mortgage as.

Get a clear breakdown of your potential mortgage payments with taxes and insurance included. If your debt payments are less than 36 percent of your pre-tax income youre typically in good shape. Assuming you have a 20 down payment 40000 your total mortgage on a 200000 home would be 160000.

Check the IRS website for the latest information about income taxes and your state tax website for state-specific information. Use our free mortgage calculator to estimate your monthly mortgage payments. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 718 monthly payment.

Taxes are collected annually based on assessed property values that are recalculated every two years. The original Social Security Act was enacted in 1935 and the current version of the Act as amended encompasses several social welfare and social insurance programs. The debt-to-income ratio does not take into account such big expenses as income taxes health insurance or car insurance.

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. If you are unlikely to itemize your deductions you can set your state federal tax rates at zero in our refinancing calculator to remove the impact of taxes on the calculators output. Lenders look most favorably on debt-to-income ratios.

Factors in Your California Mortgage Payment.

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

8025 State Highway 25 Ne Monticello Mn 55362 Mls 6153535 Edina Realty

Can I Reduce Tax Amount By Keeping My Money Hidden On A Safe At Home Serious Quora

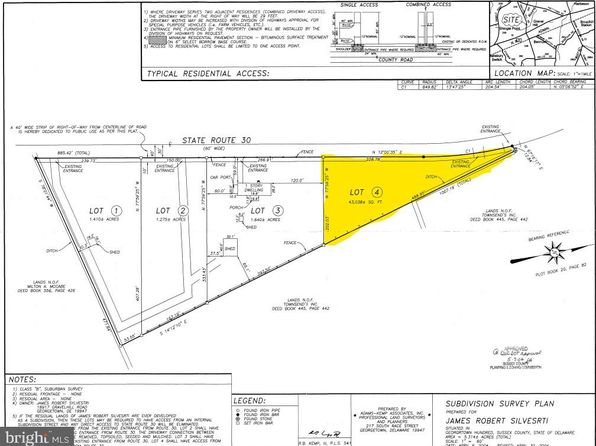

Milton De Land Lots For Sale 36 Listings Zillow

275 279 Lawrence Road Windsor Ny 13865 Compass

This Article Explains The Amortization Calculation Formula With A Simple Example And A Web Based Ca Home Equity Loan Home Equity Loan Calculator Mortgage Loans

2

It S Critical Buyers Budget For Closing Costs To Avoid Sticker Shock Days Before Closing Source National Associa Closing Costs Underwriting Real Estate Tips

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax District Of Columbia Tax

6410 Timber Arch Dr Chaska Mn 55318 Realtor Com

36 11 Acres Locust Hill Road Blue Springs Ms 38828 Crye Leike

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Orangeville Real Estate Agent Jennifer Jewel Specializing In The Orangeville Caledon And Shelburne Area Year Mortgage Infographic Mortgage Payoff Rent Vs Buy

2

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

6410 Timber Arch Dr Chaska Mn 55318 Realtor Com

Virginia Financial Services Businesses For Sale Bizbuysell